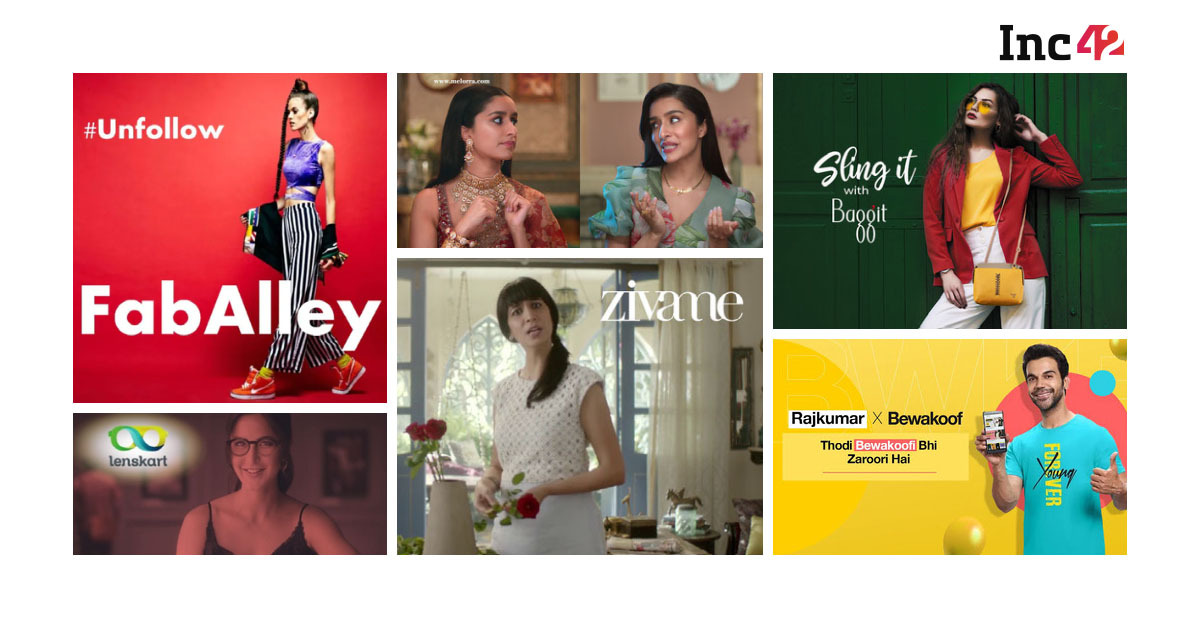

Compared to another consumer-facing sector, the style trade has seen too many modifications throughout each perform and sub-segment, from design and developments to manufacturing and merchandising. It was a darkish time when India’s iconic muslin and pashmina fell to mass-produced, machine-made garments within the colonial period. But with the revival of conventional crafts post-Independence, the emergence of latest kinds and the approaching of age of latest genres of trend colleges, each excessive trend and mass clothes in India have advanced at a quick clip in sync with world markets. As new developments and concepts, together with new applied sciences, proceed to push the envelope, the trade has grown steadily. In 2015, the organised trend market in India stood at $41 Bn and grew at a CAGR of 10% to achieve $67 Bn in 2020. It is anticipated to develop on the similar tempo and attain $107 Bn by 2025, in line with Wazir Advisors, a Delhi-NCR primarily based enterprise advisory agency.Interestingly, the rise of digital infrastructure throughout India, particularly the quick adoption of ecommerce by new-age trend manufacturers, has performed a major function on this development narrative. Online retail has made it straightforward for not-so-popular direct-to-consumer (D2C) manufacturers to achieve out to their audience and develop their gross sales in a viable manner as an alternative of spending lakhs and crores on offline growth and advertising. The first to undertake the brand new mannequin was Yepme, a Gurugram-based trend model that began its operations in August 2011. Yepme’s on-line enterprise mannequin underlined how a primarily touch-and-feel class like trend might see the retail motion away from elegant studios and well-embellished retail shops. To drive its enterprise additional and improve buyer attain, the corporate additionally focused Tier 2 and Tier 3 cities the place massive manufacturers not often arrange their bodily shops. Incidentally, Myntra launched in 2007 as a present personalisation platform however pivoted to a trend market in 2011 and launched its non-public label the following yr. Koovs was one other early entrant in 2009, however in its preliminary days, it operated as a deal web site and later pivoted to electronics (2010) and trend (December 2011).In the following few years, a sequence of progressive modifications and pivots passed off as manufacturers, new and outdated, began transferring to the web house to make good of this tech-powered newfound promoting alternative. For occasion, in 2014 retail trend model Biba entered the digital sphere. Then, 2016 marked the entry of Reliance retail and Tata Unistore coming into the web trend phase by way of AJIO and Tata CLiQ. Given the unprecedented development, the web trend market spurted. It was valued at $17.8 Bn in H1 2021 and is anticipated to the touch $43.2 Bn by 2025, in line with Inc42’s newest D2C report Decoding India’s $100 Bn+ Opportunity. More curiously, the web market accounts for 33% of your entire trend market in India and should seize about 50% of the market share by 2025. But taking residence a chunk of this pie is simpler stated than carried out. For occasion, homegrown manufacturers focussing on on-line play are but to leverage the benefits of trend tech that covers all elements, from imaginative and prescient to put on, from on-line styling, becoming and customisation to utilized sustainability and superior buyer expertise. Bridging this ‘expertise’ hole has all the time been a troublesome problem for these manufacturers. They want to seek out the precise options (tech and in any other case) to supply a web-based expertise much like offline purchasing and thus stand out from on-line and offline friends. Why Brands Need To Focus On The Future India is residence to 100+ on-line trend manufacturers, in line with a report by Avendus, Mumbai-based monetary providers agency. This knowledge reveals two distinct elements: First, the sector’s huge potential, and second, the cutthroat competitors within the on-line trend house. The rise in competitors within the on-line house (additional triggered by the pandemic as offline manufacturers have joined the fray resulting from frequent lockdowns) has pushed digital-first manufacturers to think about progressive options that may serve current and future necessities. According to trade insiders, grabbing the market share right here and now will solely work short-term. But to make sure long-term development, D2C manufacturers ought to stay ready for the modifications that may drive the way forward for trend. They must visualise a market of 300/400 Mn web shoppers in comparison with the present 190 Mn+. Besides, the competitors will get harder as extra trend startups and legacy manufacturers are eager to enter this house to cater to a wider client base. Hence, the manufacturers ought to deal with the longer term and develop scalable methods to entice and retain clients. Decoding future developments and buyer preferences might not be as tough because it appears. Keeping an eye fixed on world improvements, worldwide client behaviour and India-specific client knowledge will assist corporations perceive how India’s trend story might pan out. Here is a living proof that tells us how a retail development in China is more likely to influence Indian customers. Lately, Chinese manufacturers are betting massive on influencer-led reside commerce the place on-line reside streaming is linked to an ecommerce retailer. This permits customers to work together with their favorite influencer/model consultant through chat and store on the similar time, making issues extra participating and enjoyable. Interestingly, this development is spreading quick in North America and Europe. According to a McKinsey article, a Tommy Hilfiger reside commerce present reportedly had an viewers of 14 Mn and offered 1,300 hoodies in two minutes. There isn’t any actual replication of this format but in India. But the nation is witnessing a substantial deal with engagement after Nanjing-based fast-fashion big Shein made a comeback to the Indian market as an Amazon vendor in July 2021. The model rewards its clients not merely for buy however a whole gamut of actions, together with log-in, importing opinions with product pictures, watching reside streaming and taking part in outfit challenges. Using these options, the model goes past the routine actions of a transactional platform and provides extra incentives for a buyer to remain, have interaction and probably buy. In essence, the world turns into a linked village on the subject of trend, and international locations and even area of interest client segments shortly meet up with world developments. So, it’s straightforward to know the significance of scaling up in tune with these developments.From interactive trend tech to reside/social commerce, the choices are loads for D2C manufacturers to zero in on scalable methods as per their necessities. But what issues most is the short and environment friendly implementation of such options, with an eye fixed on customisation. For occasion, Prabhkiran Singh, cofounder of the attire model Bewakoof, is eager to make purchasing extra social in sync with world developments. According to him, limited-time reductions on purchases or incentives for product suggestions, likes and feedback will assist on-line customers get a style of the social environment that offline customers take pleasure in at bodily shops. It additionally kinds the core of social commerce that’s quick catching up globally and in India.“Shopping has all the time been a social factor to do. When we consider purchasing, we consider going out with household and mates and having an excellent time. So, digitally native manufacturers must incentivise group purchasing to compete with the offline expertise,” he says.Decoding The D2C Fashion PlaybookDigital-first D2C trend manufacturers have come a good distance because the on-line enterprise mannequin took off in India. With well-established provide chains, advertising channels and manufacturing processes in place, these manufacturers at the moment are in a first-rate place to deal with innovation and keep future-ready. At the lately concluded D2C summit hosted by Inc42, we interacted with a variety of manufacturers — from high-end trend to fantastic jewelry to eyewear and extra — to deep dive into the cutting-edge methods of main gamers. Here is a have a look at the imaginative and prescient and the highway map every firm is following to make the model stand out.Melorra: Fast Fashion, Asset-Light Model Giving An EdgeThink fantastic jewelry, and you’d nonetheless flip to an offline outlet or model retailer that you’ve got trusted for years. Set up in 2015 by Krishna Kumar and Saroja Yeramilli, Bengaluru-based on-line fantastic jewelry model Melorra confronted the identical belief challenge associated to a large-ticket buy. It was tough to alter in a single day the time-honoured notion of offline consumers. So, the D2C startup determined to pursue product innovation to disrupt the trade. As a primary step, the corporate moved away from conventional templates and went for stylish and light-weight purposeful objects, figuring out millennial girls as its goal shoppers. Next, it opted for an asset-light zero-inventory mannequin and solely specialised in custom-built jewelry utilizing 3D printing expertise and including stones later. In an interview with Bloomberg TV, Yeramilli stated that the mannequin was adopted to get rid of the stress of liquidating outdated or surplus stock and deal with quick trend. Melorra calls itself the Zara of on-line jewelry and releases a brand new assortment each Friday. (Almost all quick trend manufacturers create weekly product strains as they cater to ‘52 micro-seasons’ per yr.) Speaking concerning the challenges on this journey at Inc42’s D2C Summit, Yeramilli stated it took greater than three years of experimentation to excellent the asset-light mannequin. Stressing on how innovation on the manufacturing degree could possibly be a technique for disruption, the corporate claimed to have recorded a 200% YoY development in FY20 and anticipated a 5x rise in income in the identical yr. However, it has not revealed its financials for FY20 but.Bewakoof: Thriving On New Process Creation There are T-shirts and T-shirts, after which there may be Bewakoof that brings a smile to 1’s face. The Mumbai-based e-retail enterprise was began by IIT-Bombay alumni Prabhkiran Singh and Siddharth Munot in 2012. The firm recognized faculty college students and millennials as its audience and began producing humorous T-shirts (we imply the messages printed on them are humorous) to seize the market. The model made waves, and in 2013, clocked greater than 1 Lakh followers on Facebook, the place it was primarily advertising its merchandise. But because it scaled, the model’s biggest energy turned out to be the largest enterprise problem. Due to its giant SKU (the model releases a brand new design daily), the corporate needed to maintain a low MOQ (minimal order amount). But it was unable to discover a firm that might make so few T-shirts. Eventually, Bewakoof arrange its manufacturing facility and warehouse in 2013. The model now claims to promote greater than 20K merchandise each single day.The firm clocked a income of INR 210 Cr in FY20 and improved its earnings by 28% in comparison with the earlier yr when it earned INR 164 Cr. The on-line retailer additionally experimented with completely different fashions to aggressively scale its operations. But there may be extra to this development story. Bewakoof launched its magnificence and private care model Cosmos in July this yr and entered video commerce with its in-app characteristic referred to as B’Shots. “D2C isn’t just a distinct segment creation to step away from legacy manufacturers. It is, in its entirety, a process- creation to handle points at each product touchpoint,” stated Singh on the D2C Summit.Zivame: Banking On Body Confidence Women’s innerwear isn’t showcased and infrequently offered surreptitiously at brick-and-mortar retailers. But Bengaluru-based Zivame determined to convey lingerie to mainstream trend and make a hit story of it. Set up in 2011 by Kapil Karekar and Richa Kar, it was one of many earliest Indian manufacturers to enter this house. It had too few opponents, which meant buyers had much less confidence on this phase resulting from its near-taboo standing in India. This isn’t any exaggeration. In an interview with Firstpost, Kar associated the difficulties she confronted find acceptance for her work. While staying in Bengaluru, she couldn’t even divulge to her landlord what she did for worry of getting evicted. For Zivame, the largest problem lay in breaking the taboo and creating an surroundings the place shoppers can overtly talk about innerwear purchasing and equate it with shopping for different couture merchandise. Therefore, the model’s advertising technique has advanced round spreading consciousness and constructing a neighborhood the place folks can freely speak about lingerie as an merchandise of necessity and luxurious. As an extension of its philosophy, the corporate lately launched a physique positivity marketing campaign titled Dekho Maine Kya Kiya (Look what I’ve carried out). Through its commercials, social media posts and web site, the model has promoted physique confidence and claims to have seen 50-60% larger visitors on its platform than pre-Covid occasions. The firm has captured a major market share of the premium lingerie phase and clocked a income of INR 222.8 Cr in FY20, exhibiting a YoY development of 57.1%. It additionally aimed to extend its offline shops from 35 to 60, focussing on Tier 2 and Tier 3 cities to make sure a extra focused omnichannel strategy.“Zivame goals to supply girls with a private and inclusive platform to buy all their intimate put on wants. Plus, it’s constructing a safe and personal neighborhood to encourage conversations round their experiences,” says Khatija Lokhandwala, the model’s head of promoting.FabAlley: Customer Engagement, Predictive Analytics Gaining TractionA western quick trend model began by Tanvi Malik and Shivani Poddar in 2012, FabAlley specialises within the mass-premium vary (Delhi-NCR-based High Street Essentials is the guardian firm with the identical founders). As an early entrant, the corporate was capable of faucet into the inflow of web shoppers and shortly constructed a model identification. Better nonetheless, the model has adopted trend tech and makes use of an AI-powered advice engine that curates catalogues primarily based on buyer choice and knowledge mining. The consequence: Users have a hassle-free expertise and get to see the merchandise they like most. All was hunky-dory with the model till the primary wave of the Covid-19 pandemic when trend purchases took successful. After mulling issues over, FabAlley determined to take down its consolation put on vary and created a work-from-home product line and protecting put on (face masks) vary. The merchandise had been a giant hit among the many client base.Besides, the corporate focussed on post-purchase expertise and began including product notes to make folks conscious of cloth varieties and their professionals and cons. It additionally used third-party instruments like ClickPost Tracking to maintain clients up to date about delivery.With the deal with the suggestions loop, predictive analytics and quick time to market, the model claims a 50% YoY improve in income in FY21. As FabAlley recorded a income of INR 180 Cr in FY20, a back-of-the-envelope calculation reveals that the income in FY21 needs to be round INR 270 Cr.Lenskart: Changing Perception, Increasing Touchpoints WorkThings will need to have labored out properly for a model that has topped the funding desk within the D2C phase with $774 Mn since its inception. But the Delhi-based eyewear firm, based in 2010 by Peyush Bansal, Amit Chaudhary and Sumeet Kapahi, confronted a few crucial challenges from the get-go. First, very similar to different trend objects, eyewear is a typical look-and-feel phase. But right here, the main focus is on match, consolation and accuracy, particularly if corporations present prescription glasses. Understandably, client belief is kind of low on the subject of on-line buy of eye care merchandise which will have an effect on one’s imaginative and prescient. Second, in 2010, distribution channels had been restricted and costly as manufacturers needed to promote by way of intermediaries.In addition to fixing imaginative and prescient issues, eyewear as a trend accent has been right here for a very long time, but it surely has all the time been a distinct segment phase. However, a decade in the past, market consultants noticed a whole lot of potential on this class, and Lenskart determined to construct a solutions-driven eyewear model that might combine care and magnificence components. It got here up with a bunch of options equivalent to 3D try-on and eye check-up providers at residence to construct client belief and engagement. Better nonetheless, it began working as a market and allowed different manufacturers to promote on its platform. The product selection jumped together with Lenskart’s income. The firm clocked INR 38 Cr in FY14, a 375% rise from INR 8 Cr within the earlier monetary yr.In the method, the model was fixing its first crucial drawback. It was constructing belief and altering notion by way of mind-boggling product varieties, widespread gross sales, at-home providers and extra. “You have to know deep client wants. When we entered the market, glasses had been nonetheless largely related to eyecare and never thought of trend equipment. We tried to alter that notion and make shoppers assume that even spectacles is usually a trend assertion,” says Bansal. Its distribution channels have additionally grown exponentially. In 2015, the model opted for an omnichannel mannequin and began launching its offline shops. Lenskart now operates 750+ shops in additional than 175 cities. Unlike many D2C manufacturers, Lenskart’s major technique is to be accessible at each buyer touchpoint and improve its visibility. From Google rating and social media hype (by way of adverts and influencer advertising) to print media and tv promoting, from market play and m-commerce to offline retail, the model has forayed in all places to maximise its omnichannel play and develop sustainably. Its technique seems to have paid off because the model practically doubled its income from INR 485.5 Cr in FY19 to INR 963.7 Cr in FY20. It additionally reported a revenue of INR 17.7 Cr in FY20. The Bottom Line Although extensively completely different by way of merchandise, goal markets, challenges and options, the journey of those 5 manufacturers have a typical script. And the narrative is all about how D2C trend manufacturers (in reality, the style sector itself) are engaged on (product) customisation, comfort, and care (learn buyer care and engagement) to cater to trend fanatics throughout the nation. Their goal clients are primarily millennials or Gen Z, however trend, throughout classes and segments, by no means fails to attraction to a a lot larger viewers. Thanks to its burgeoning development, the trade has additionally captured buyers’ curiosity. Fashion D2C manufacturers raised $756 Mn in funding throughout 123 offers between 2014 and April 2021. What’s extra, trend has topped the funding listing among the many D2C sectors. The message is obvious. This phase will proceed to current many alternatives so long as manufacturers can establish their audience and meet their particular necessities whereas doing clever problem-solving.