It’s a $20 billion, 100-point, bust-boom-bust spherical journey for the ages.

After touching a lockdown low 24 months in the past, the substitute intelligence (AI)-powered private styling website Stitch Fix has gone from trough (~$11) to document excessive (~$110) and now again once more (final buying and selling round $9) as neither traders nor clients appear capable of make up their minds in regards to the deserves of this 10-year-old attire enterprise.

Going into Tuesday’s (March 8) fiscal second-quarter earnings report, the San Francisco-based firm had already seen its inventory drop practically 90% over the previous 10 months, however inside minutes of that launch, Stitch Fix shares would shed practically 20% extra on phrase that its “onboarding and conversion charge” have been difficult, and its income this quarter could be down 7% to 10%.

“Conversion of latest guests at each [stylist-assisted] Fix and [curated, self-purchasing] Freestyle is just not the place we wish it to be,” CEO Elizabeth Spaulding instructed analysts and traders on the corporate’s webcast. In addition, the chief who assumed the CEO position from firm founder Katrina Lake seven months in the past mentioned adjustments in Apple’s iOS 14 advertising and marketing channels had additionally hindered Stitch Fix’s means to focus on new purchasers — which as of Jan. 29 stood at 4 million lively customers, a 4% improve from the identical interval final yr.

As a consequence, Spaulding mentioned, the corporate skilled decrease new shopper additions than anticipated which in flip noticed it rein-in advertising and marketing spend by practically 20% within the quarter, after which lastly resulted within the new slashed Q3 outlook and retracted full yr steerage.

For an organization and a platform that simply 10 months in the past was being lauded as the proper answer for the lockdown, work-from-home wardrobe refresh cycle, Stitch Fix has immediately discovered itself unraveling on the seams.

Silver Linings

Beneath the mud cloud of its tumbling inventory value, which has slimmed the corporate’s market worth from over $20 billion to simply $1 billion, the retailer’s government workforce repeatedly moved to spotlight the positives, comparable to its document income per shopper which was up 18% from final yr to $549.

While whole income grew 3%, gross sales at its new Freestyle self-purchasing section rose 29%.

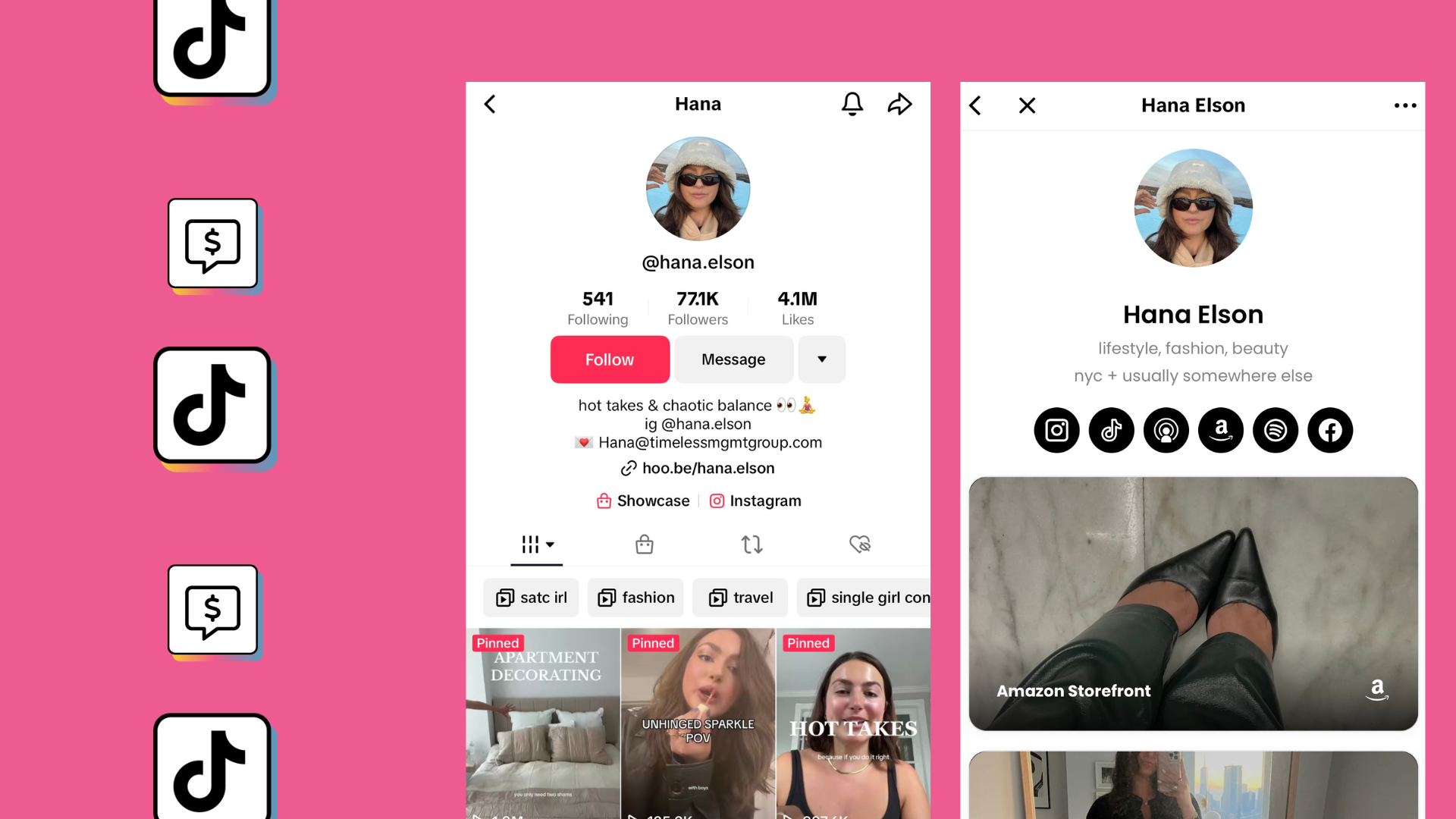

“On the advertising and marketing entrance, we can be increasing into issues like Freestyle, collaborating in issues like search engine optimization, collaborating in a variety of different advertising and marketing channels like online marketing, and influencer advertising and marketing,” Spaulding mentioned, noting that the corporate was pivoting to a a lot wider portfolio of latest advertising and marketing channels after having turn out to be reliant on present ones that had gotten dearer.

Although the corporate has been round since 2011, the management workforce’s long-term imaginative and prescient for the model stays intact, and its position as a supplier of an enhanced, hybrid procuring expertise that marries expertise and private service nonetheless seen as legitimate and viable.

“As we proceed to scale, we imagine that this is usually a very worthwhile enterprise over time, we’re simply nonetheless within the enterprise mannequin evolution in addition to the scaling section,” Spaulding mentioned, earlier than reiterating her intention to reboot onboarding and simplify the steps concerned in changing browsers into patrons after which into recurring clients.

That change, after all, won’t occur in a single day and the corporate made clear that the close to time period can be difficult. In acknowledging the softness within the variety of lively purchasers it has introduced in over the previous six months, in addition to the uncertainty surrounding its efforts to enhance conversion, Stitch Fix lowered the full-year income outlook it gave three months in the past.

For the following quarter and a half and the fiscal yr that ends July 30, the corporate mentioned it now expects income to be “flat to barely down” versus 2021.

——————————

NEW PYMNTS DATA: ACCOUNT OPENING AND LOAN SERVICING IN THE DIGITAL ENVIRONMENT

About: Forty-two % of U.S. shoppers usually tend to open accounts with FIs that make it straightforward to auto-share their banking particulars throughout sign-up. The PYMNTS examine Account Opening And Loan Servicing In The Digital Environment, surveyed 2,300 shoppers to look at how FIs can leverage open banking to have interaction clients and create a greater account opening expertise.

https://www.pymnts.com/information/retail/2022/stitch-fix-is-broken-onboarding-conversion-ad-spend-crush-covid-era-darling/