The FCA financial guidance printed on 26 March 2024 acknowledges that social media has turn into a central a part of companies’ advertising methods permitting them to succeed in a big viewers with better velocity and effectivity. However, the FCA is worried that poor high quality financial promotions on social media can result in vital client hurt because of the complicated nature of financial services and the potential extensive attain of financial promotions referring to such services. In gentle of the altering nature of social media and the introduction of great regulatory adjustments such because the Consumer Duty, the FCA is publishing its guidance to make clear the applying of the FCA’s current guidelines and insurance policies and supply guidance on the financial promotion perimeter. Firms stay accountable for the compliance of each promotion they make or trigger to be made they usually additionally want to make sure that influencers they work with adjust to the financial promotion guidelines and guidance when they’re speaking with their followers.

The FCA’s finalised guidance (FG24/1) particulars how financial promotions must be communicated on social media. It additionally summarises responses to the July 2023 guidance session as set out in our earlier Engage article.

FG24/1 seeks to make clear the applying of the FCA’s current guidelines and insurance policies and supply guidance on the financial promotion perimeter. The guidance is related to:

Authorised individuals concerned in speaking or approving financial promotions on social media.

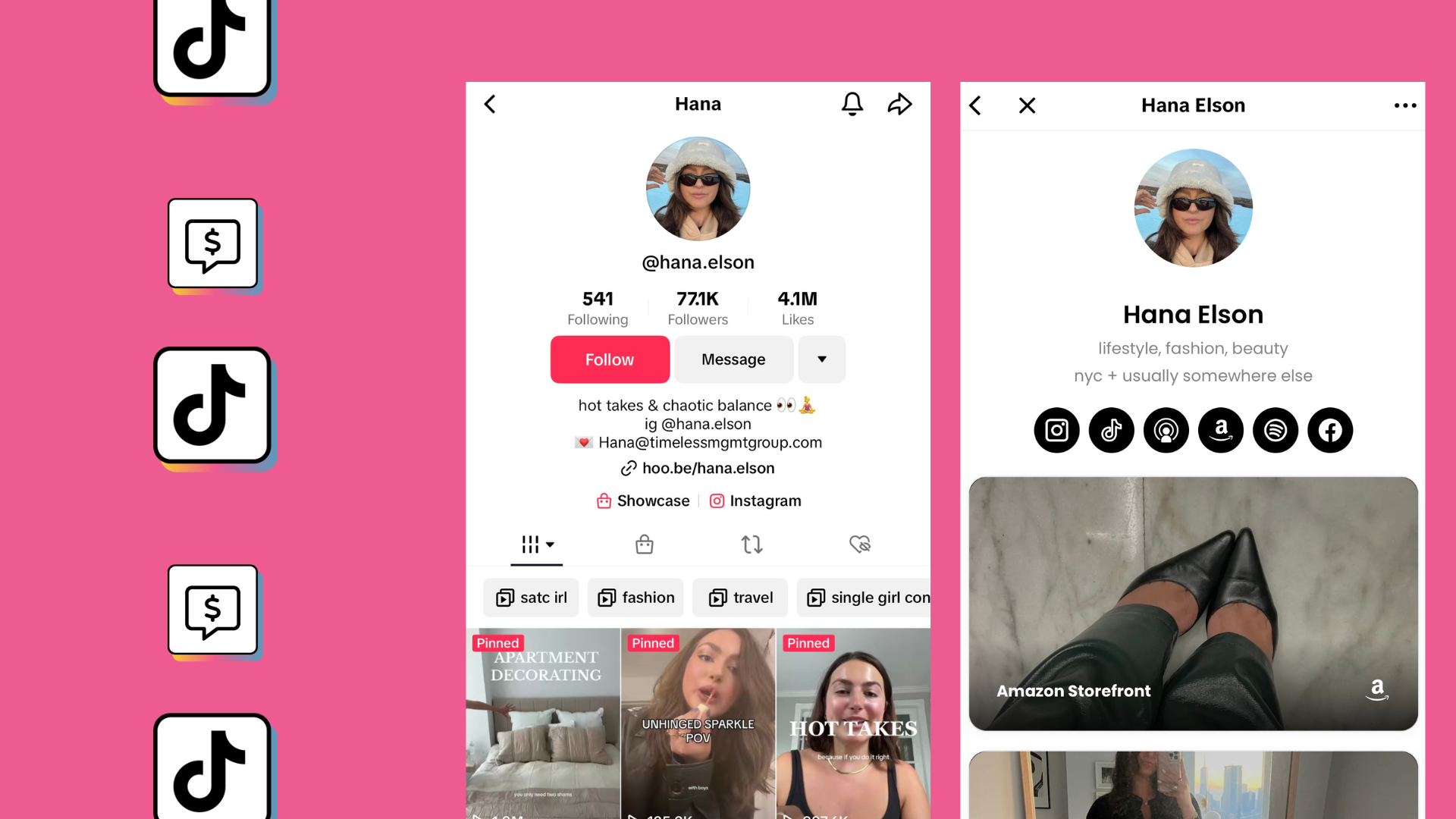

Unauthorised individuals, together with influencers or different affiliate entrepreneurs, concerned in speaking financial promotions on social media.

Trade our bodies that characterize the above teams.

Key takeaways from the financial promotions social media guidance

FG24/1 reiterates the next key takeaways for companies:

The financial promotions guidelines are medium agnostic. The guidance re-emphasises that any type of communications (together with by way of social media) is able to being a financial promotion if it contains an invite or inducement to have interaction in funding exercise. This can embrace communications by way of ‘non-public’ or invitation solely social media channels like chatrooms resembling Discord and Telegram, posts on public discussion board web sites resembling Reddit in addition to content material or communications by unauthorised ‘finfluencers’. Memes are additionally highlighted as a kind of communication that’s able to being a financial promotion and topic to the financial promotion restriction – an instance is offered in FG24/1. The use of memes by finfluencers is especially prevalent within the cryptoasset sector.

The significance of standalone compliance – every communication should adjust to the FCA’s guidelines when thought of individually. The FCA offers guidance on learn how to assess whether or not new types of communication (resembling Instagram tales) would meet this requirement.

Adverts throughout social media channels should be honest, clear and never deceptive, they need to present a balanced view of the advantages and dangers and carry the prescribed threat warnings so customers could make efficient, well-informed financial selections.

Firms ought to take proactive duty for a way their associates talk financial promotions. This contains having applicable monitoring and oversight programs to make sure that associates perceive their tasks and don’t talk unlawful or non‑compliant financial promotions. Firms stay accountable for the compliance of each promotion they make or trigger to be made.

Unauthorised individuals, resembling influencers, who promote financial services or products which can be topic to regulation with out the approval of an FCA authorised particular person are reminded that they could be committing a felony offence punishable by as much as 2 years imprisonment, the imposition of an infinite high quality, or each. Influencers ought to take into account whether or not they’re the precise particular person to advertise a services or products when contemplating what guidelines and requirements apply to their actions. This contains the ASA’s expectation that they need to label their content material as an commercial upfront (together with affiliate hyperlinks) in the event that they get any type of fee.

Key questions that companies ought to take into account in relation to social media financial promotions?

The guidance raises some essential questions on social media financial promotions.

Is the communication balanced? Firms are required to make sure that customers will probably be offered with a balanced view of the advantages and dangers of the promoted services or products. The applicable stage of element for a promotion that helps client understanding will depend upon elements resembling audience, what info recipients must know, the type of determination recipients should make and any potential sources of confusion. Firms must ask – is social media the suitable channel?

Can the communication convey the complexity of the product? Social media helps fast buyer engagement, which could not be appropriate for all merchandise, particularly high-risk financial devices that will be tough for customers to know. The possible viewers must be thought of. For instance, CONC 3.9.2G confirms that because of the complexity of debt counselling options it’s unlikely that social media which offers restricted house for messages can be appropriate for financial promotions about debt options. Equally, the FCA is worried about exempt buy-now-pay-later (BNPL) promotions and confirms that companies selling BNPL merchandise ought to embrace the related dangers for these merchandise.

Are the chance warnings outstanding? Space is at a premium for these communications; take into account whether or not threat warnings have been truncated by the performance of the platform as this may occasionally influence client understanding (supporting client understanding is a key requirement of the Consumer Duty). Firms ought to confer with current guidance on financial promotion prominence which incorporates good and dangerous follow. Firms must also make sure that prescribed threat warnings are utilized the place required – e.g. for HRIs and high-cost-short-term credit score merchandise (HCSTC).

Is the agency making use of the related advertising restrictions for the merchandise they’re selling – e.g. companies which can be selling excessive threat investments (HRIs) ought to make sure that they’re making use of the precise promotion restrictions set out in COBS 4.12A, COBS 4.12B and COBS 22. The complete threat warning must be clear and never require click-through entry. Table 1 on web page 20 of the guidance units out how prescribed threat warnings must be utilized to sure forms of social media channels.

What are the related Consumer Duty issues? For instance, is the financial promotion tailor-made to the goal market and subsequently more likely to be understood by the viewers (common client testing could also be applicable)? Firms promoting on social media should take into account how their advertising methods align with performing to ship good outcomes for retail customers. Is there a threat that customers are getting bombarded by social media financial promotions the place they’re weak? How can this threat be mitigated the place it’s pushed by social media algorithms? FG22/5 outlines good and poor follow beneath the Consumer Duty that companies ought to confer with.

How ought to companies deal with the chance of forwarding and sharing? Social media content material is usually forwarded on or shared which might create non-compliance. It will depend upon the content material and context of the social media put up whether or not this can quantity to communication of a financial promotion. Firms stay accountable for compliance in the event that they share the put up regardless that the agency didn’t generate the unique content material of the communication. Firms ought to evaluation the prevailing guidance on speaking and its relevance to financial promotions in PERG 8.6.

Affiliate advertising – does the agency have applicable programs and controls in place? Firms are required to take proactive duty for a way their affiliate entrepreneurs talk financial promotions. Firms are responsible for the compliance of any financial promotion made by their affiliate marketer even when they haven’t been concerned within the improvement or creation of the content material – if the agency’s referral hyperlink is on the advert then they’re accountable. Firms ought to guarantee they’ve correct programs and controls to handle how their promotions are used on social media. Affiliate entrepreneurs ought to concentrate on different requirements and guidance making use of to their actions such because the ASA’s guidance on on-line internet online affiliate marketing.

Next steps

The FCA is changing its earlier 2015 social media guidance with FG24/1 in gentle of the altering nature of social media and the introduction of great regulatory adjustments such because the Consumer Duty because the final guidance was printed in March 2015. Whilst the Guidance doesn’t create new obligations for individuals who promote financial services on social media, it does assist to make clear how companies may method complying with current regulatory obligations. The Guidance additionally helps to make clear for non-authorised individuals when communications fall inside the FCA’s regulatory perimeter and the way the FCA’s guidelines may apply to their actions.

If you wish to talk about the finalised Guidance set out in FG24/1 with our financial promotion regime specialists, please get in contact with the Hogan Lovells contacts listed on this article.

[View source.]

https://www.jdsupra.com/legalnews/uk-fca-finalises-social-media-financial-5656879/