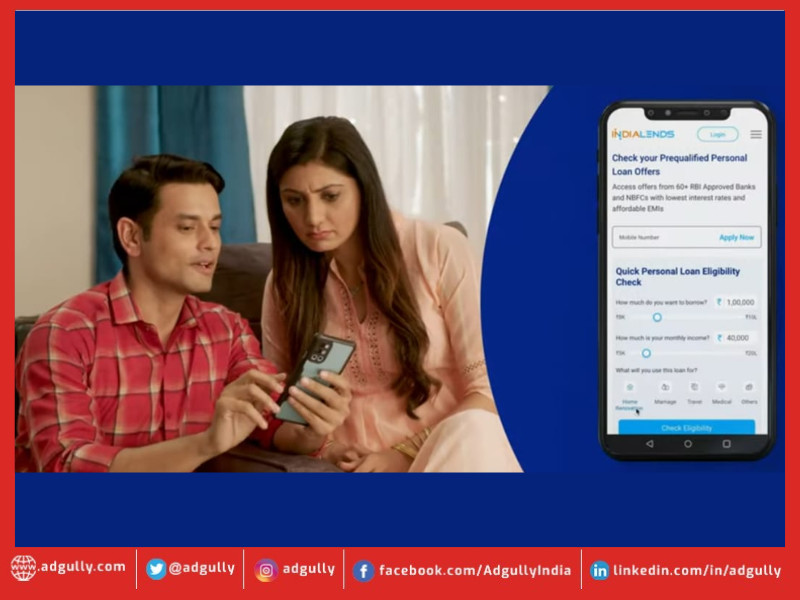

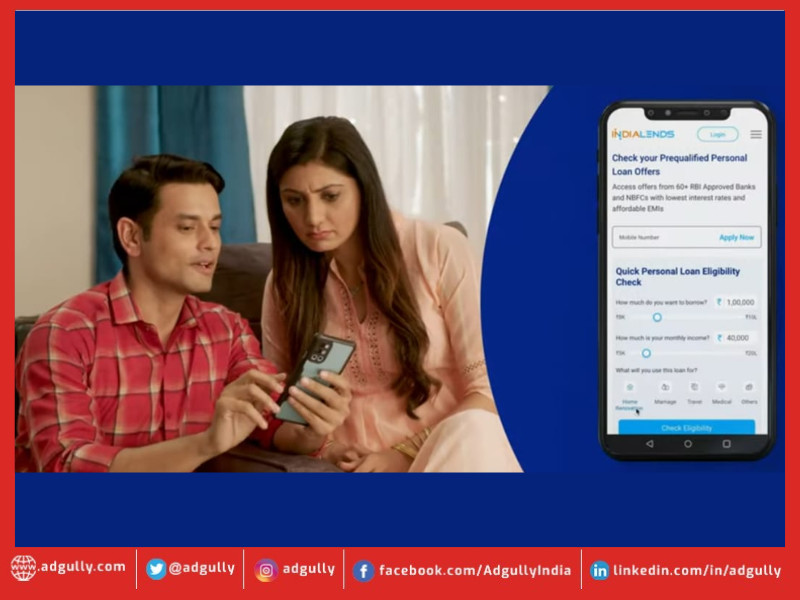

In the midst of the festive season, IndiaLends, an internet market for loans and bank cards, has launched its video campaign #TarakkiKiTayari. The campaign goals to carry consciousness across the right use of credit score for private and monetary progress for early in addition to new to credit score clients.

The digital campaign was launched as a part of IndiaLends communication narrative specializing in the importance of non-public progress for India’s youth. The campaign was launched over the weekend throughout IndiaLends’ social media platforms. The firm is leveraging the video campaign by means of influencer advertising – with numerous social media influencers like life-style influencers together with Shivangi, Dushyant, Aanchal, couple journey influencers Archana & Vidur, and parental influencer like Priyanshi. The lending main goals to achieve out to millennials with this campaign.

Through the campaign, IndiaLends goals to catch the heartbeat of the millennials, for whom self-growth has turn into extraordinarily important. The #TarakkiKiTayari campaign motivates millennials to bear in mind about the easiest way to make use of credit score merchandise in a means that might contribute to particular person private progress and fulfill the aspirations. The campaign showcases how IndiaLends helps in planning expenditure and permits one to meet their wants with out compromising monetary well being.

IndiaLends’ Head of Brand and Marketing Ankit Khurana mentioned, “The festive season is a particular time for people and households. The festivities mark the onset of new beginnings. Keeping in thoughts the symbolism of the festivals celebrated throughout our nation, we launched #TarakkiKiTayari campaign to carry the deal with fulfilling aspirations with out hampering monetary stability. Since ‘private progress’ is necessary we showcased how the objective of non-public and monetary progress could be met by successfully utilizing credit score merchandise.”

For the campaign, the inventive companies concerned have been Adfactors PR and OneImpact.

IndiaLends is at present working with 60+ RBI authorized companions, which embrace main PSUs and personal sector banks, NBFCs, fintechs, and P2P lenders. The firm additionally provides an open-API mannequin for banks and NBFCs to companion with them by means of a plug-and-play strategy. The firm has over 13 million members, with over 85% of them being millennials and zillennials. The firm achieved its money break even in March 2022.

https://information.google.com/__i/rss/rd/articles/CBMiX2h0dHBzOi8vd3d3LmFkZ3VsbHkuY29tL2luZGlhbGVuZHMtZXF1aXBzLW1pbGxlbm5pYWxzLXdpdGgtdGhlaXItbmV3LXZpZGVvLWNhbXBhaWduLTEyNDQ1OS5odG1s0gEA?oc=5

_w=1200_h=630.png?v=20230522122229)